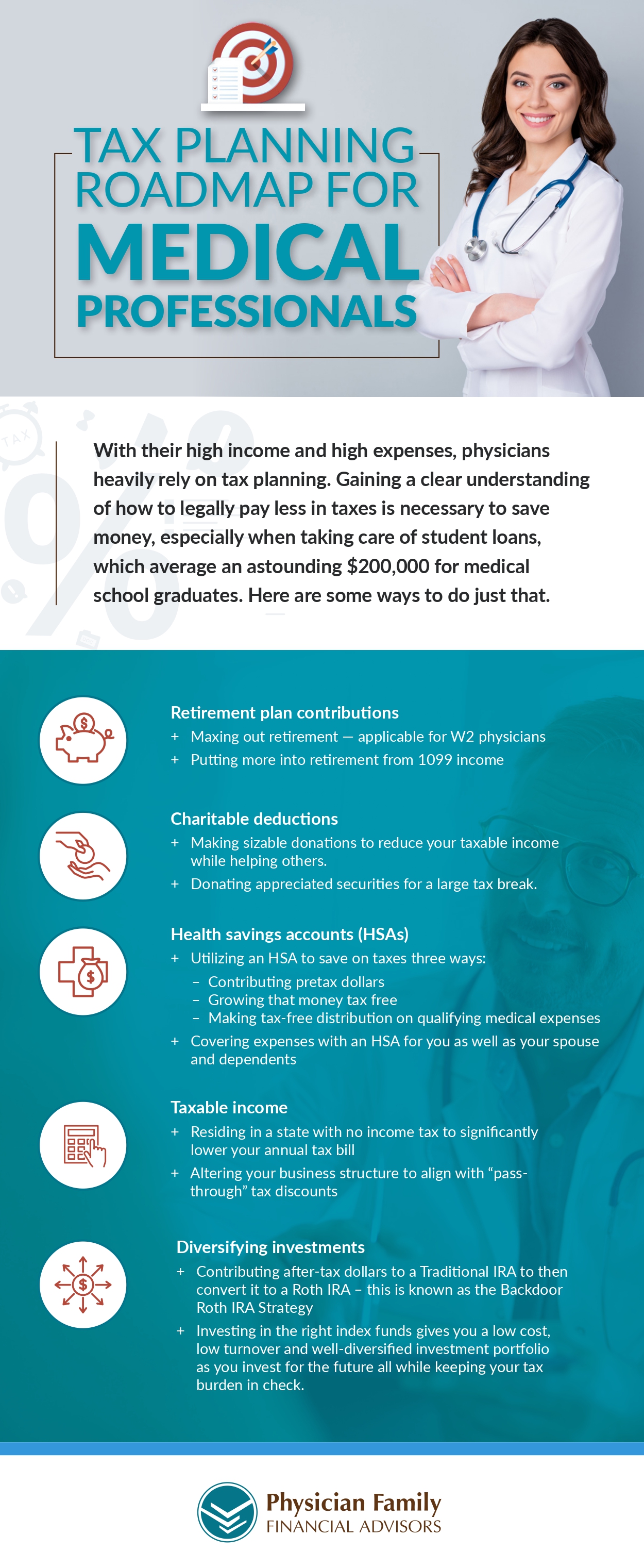

Tax-Reducing Tips For Medical Professionals

Employment in the healthcare sector can be highly financially rewarding, particularly for physicians who play a crucial role in preserving and enhancing lives. Nevertheless, being high-income earners in this field exposes these professionals to substantial expenses, primarily due to significant tax liabilities accumulated over the course of the year. This financial burden, coupled with the repayment of substantial educational debts, can significantly constrain their budget.

The good news is that despite being ensnared in a high tax bracket, there are strategies available to mitigate these expenses. In the sections below, we will explore several “tax planning” tips tailored to assist physicians and other high-income medical professionals in preserving more of their hard-earned money for the future.

Tax Planning Roadmap for Medical Professionals from Physician Family Financial Advisors, a provider of financial planning services for physicians